Sebi Registered Research Analyst | Education | Entrepreneur | Algorithmic Trader & Investor | Stock Market Trainer

April 26, 2025

We dive into why electric two-wheeler startup Ather Energy is stepping into the public markets — and why its real challenge isn’t just building scooters, but selling a vision.

The Story

India moves on two wheels — whether it’s bicycles, scooters zipping through traffic, or animal carts on village roads. And it makes perfect sense: two-wheelers are more affordable, easier to maintain, and ideally suited to India’s bustling streets. You can maneuver through lanes, park easily, and beat cars stuck at traffic lights.

No wonder India is the world’s largest two-wheeler market, selling 18.4 million units in FY24. With the rise of electric two-wheelers (E2Ws) offering sleek features, cleaner emissions, and government subsidies, the trend is only growing.

Take my brother, for example. He debated for months between a petrol scooter (ICE) and an electric vehicle (EV). Although he initially leaned toward petrol, the allure of a feature-packed EV won him over.

Enter Ather Energy — the homegrown brand founded by IIT alumni Tarun Mehta and Swapnil Jain.

Ather isn’t just another EV maker. It’s striving to create a premium brand experience. When it launched the Ather 450 in 2018, it brought India its first electric scooter with a top speed of 80 kmph, along with connected features and cloud integration through a 3G SIM card. Instead of the low-cost, mass-market route like Ola or Hero, Ather aimed to be the “Apple of scooters” — clean design, smart dashboards, premium feel.

Now, Ather is preparing for a ₹2,980 crore IPO set for April 28th. About ₹354 crore will be an Offer for Sale (OFS), while ₹2,626 crore will be a fresh issue to fuel growth, reduce debt, and survive the EV price wars.

But here’s the kicker: building a premium brand costs money — a lot of it. Ather reported losses of ₹1,062 crore in FY24, with cumulative losses over ₹2,200 crore between FY22–24. Worse still, Ather currently loses money on every scooter sold.

In the world of E2Ws, unit economics is everything. You need scale, lower costs, and smarter engineering to turn profitable.

In FY24, Ather reduced its scooter bill of materials by 20–30% by manufacturing components like motor controllers (51% cheaper) and belt drives (16% cheaper) in-house.

With the IPO proceeds, Ather plans to invest:

- ₹927 crore in a new automated factory

- ₹750 crore in R&D (including LFP battery tech)

- ₹40 crore towards debt repayment

The message is clear: better unit economics = survival.

Importantly, Ather’s struggles aren’t due to poor products — customers love its scooters. In fact, in industry surveys, Ather scored higher than Ola in customer satisfaction.

The real issue is volume.

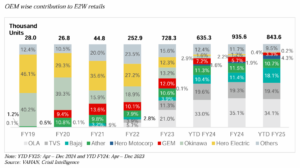

In EVs, scale is king. Despite a strong brand, Ather’s sales trail competitors. In FY24:

- Ola Electric sold 3.2 lakh units (35% market share)

- TVS sold 1.8 lakh+ units (19%)

- Ather sold 1.1 lakh units (11.5%)

Unlike rivals who launched entry-level models to capture volume, Ather targeted a niche audience — urban, tech-savvy buyers — with fewer models and a limited dealer network.

There’s another challenge: government FAME-II subsidy cuts hit Ather hard, forcing price reductions and margin pressure.

So Why Go Public Now?

Ather’s IPO isn’t just about money — it’s about credibility.

The EV market is heating up:

- Ola is already listed

- Bajaj, TVS, and Hero MotoCorp (Ather’s investor) are pushing aggressively

Ather needs “mindshare” — it wants to be seen as a tech-first premium brand standing tall among the giants. Around ₹300 crore from the IPO will go towards marketing.

And then there’s the infrastructure moat.

Ather has built the Ather Grid, with 2,500+ fast-charging stations across 300+ cities. Collaborations like:

- Cross-access with Hero MotoCorp chargers

- Portable Ather Duo chargers

- Neighbourhood chargers compatible with 3 & 4-wheelers

This charging network could become a powerful platform play, much like Tesla’s Supercharger network.

The Road Ahead

Let’s be honest — Ather is not profitable yet.

Revenue is growing:

- ₹1,617 crore in the first 9 months of FY25 (vs ₹1,254 crore in FY24 same period)

- Gross margins improved from 9% (FY24) to 19% (FY25)

But losses are still rising, and EBITDA margins remain negative.

The IPO price band is ₹304–₹321 per share — high for a company with no profits and negative returns on net worth. Plus, Ather had to slash its IPO valuation by 30% due to market conditions — raising questions.

Sure, strong tech, IP, and brand positioning might justify a premium. But at the end of the day, profits drive business and valuations drive returns.

In short:

- If you want a steady cash-flow business, Ather isn’t there yet.

- If you believe in India’s EV story evolving beyond low-cost scooters, Ather’s IPO could be worth a closer look.

Source: Company RHP