Financial Performance Overview

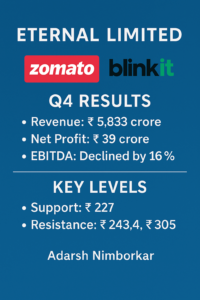

- Revenue from Operations: ₹5,833 crore, a 64% year-over-year (YoY) increase from ₹3,562 crore in Q4 FY2024.

- Net Profit: ₹39 crore, a 78% decline compared to ₹175 crore in the same period last year.

- EBITDA: Declined by 16% YoY.

The sharp drop in net profit is primarily due to substantial investments in expanding the company’s quick commerce arm, Blinkit, and increased infrastructure expenses.

Segment-wise Performance

- Blinkit (Quick Commerce)

- Revenue: ₹1,709 crore, up from ₹769 crore in Q4 FY2024.

- Adjusted Core Loss: Widened to ₹178 crore from ₹37 crore a year earlier, due to aggressive expansion.

- Store Count: As of March 31, 2025, Blinkit operated 526 stores, with a goal of reaching 1,000 by FY2025-end.

Despite losses, Blinkit’s growth highlights its potential as a major revenue contributor.

- Zomato (Food Delivery)

- Revenue: ₹2,409 crore, a 17% YoY increase, slightly below the 20% target.

- Challenges: Slower growth due to a sluggish demand environment and increased competition from quick commerce platforms.

- Hyperpure (B2B Supplies)

- Revenue nearly doubled YoY, supplying over 15,000 restaurants.

- Still operating at a loss, though revenue growth is strong.

- District (Event Ticketing)

- Launched in November 2024 after acquiring Paytm’s event ticketing businesses.

- Over 6.5 million downloads, but profitability remains a challenge.

Strategic Rebranding and Corporate Structure

In March 2025, Zomato Ltd rebranded as Eternal Ltd to reflect its diversified operations across food delivery, quick commerce, B2B supplies, and ticketing. The rebrand supports its long-term vision of becoming a multi-vertical tech company.

Future Outlook

- Blinkit Expansion: Plans to grow to 1,000 stores by FY2025, with increased focus on top-tier cities like Bengaluru, Mumbai, and Hyderabad.

- Profitability Goals: Eternal expects its new businesses to drive future revenues, aiming for over ₹47,000 crore in topline by FY2027.

Technical Analysis (Eternal Ltd – NSE: ETERNAL)

- Stock Snapshot (as of May 1, 2025):

- Current Market Price (CMP): ₹238

- Market Capitalization: ₹2,24,000 crore

- 52-Week Range: ₹286 – ₹763

- Volume: Elevated, indicating strong institutional interest

- Key Technical Levels:

- Support Zones:

- ₹227 – Recent breakout level; expected to hold as immediate support

- ₹203 – Stronger medium-term support, near previous consolidation zone

- Resistance Levels:

- ₹243.4 – Immediate resistance.

- ₹305 – Major upside target if breakout sustains above ₹243.4

- Technical Indicators:

- RSI (14-day): ~63.5 – Approaching overbought territory; watch for strength above 70

- MACD: Bullish crossover confirmed in April; momentum remains positive

- 200-Day EMA: Stock trades well above this level, confirming a long-term bullish trend

- Price Action Insight:

- Eternal Ltd is consolidating just below a key resistance at ₹243.4

- Sustained breakout above ₹243.4 could lead to a rally toward ₹305

- Dips to ₹227 or ₹203 can offer good accumulation opportunities for positional traders

- The broader trend remains positive as long as the stock holds above ₹203

Report Curated by:

Adarsh Nimborkar

Investment Advisor & Financial Analyst

Note: This report is for informational purposes only. It does not constitute a buy or sell recommendation.