At Signalz, we are committed to keeping our users up-to-date with the latest developments in the financial markets. In alignment with our mission to support informed trading, we would like to inform you about the significant regulatory changes in index options trading announced by NSE, BSE, and SEBI. These updates, effective over the coming months, are aimed at enhancing market stability, managing risks, and ensuring a fair trading environment. Here’s everything you need to know to navigate these changes and plan your trading strategies accordingly.

Effective Dates and Key Modifications

Regulators, including SEBI and the exchanges (NSE and BSE), have introduced significant changes to index options trading rules. These modifications aim to improve market stability and risk management. Below is an overview of the changes to help you stay updated:

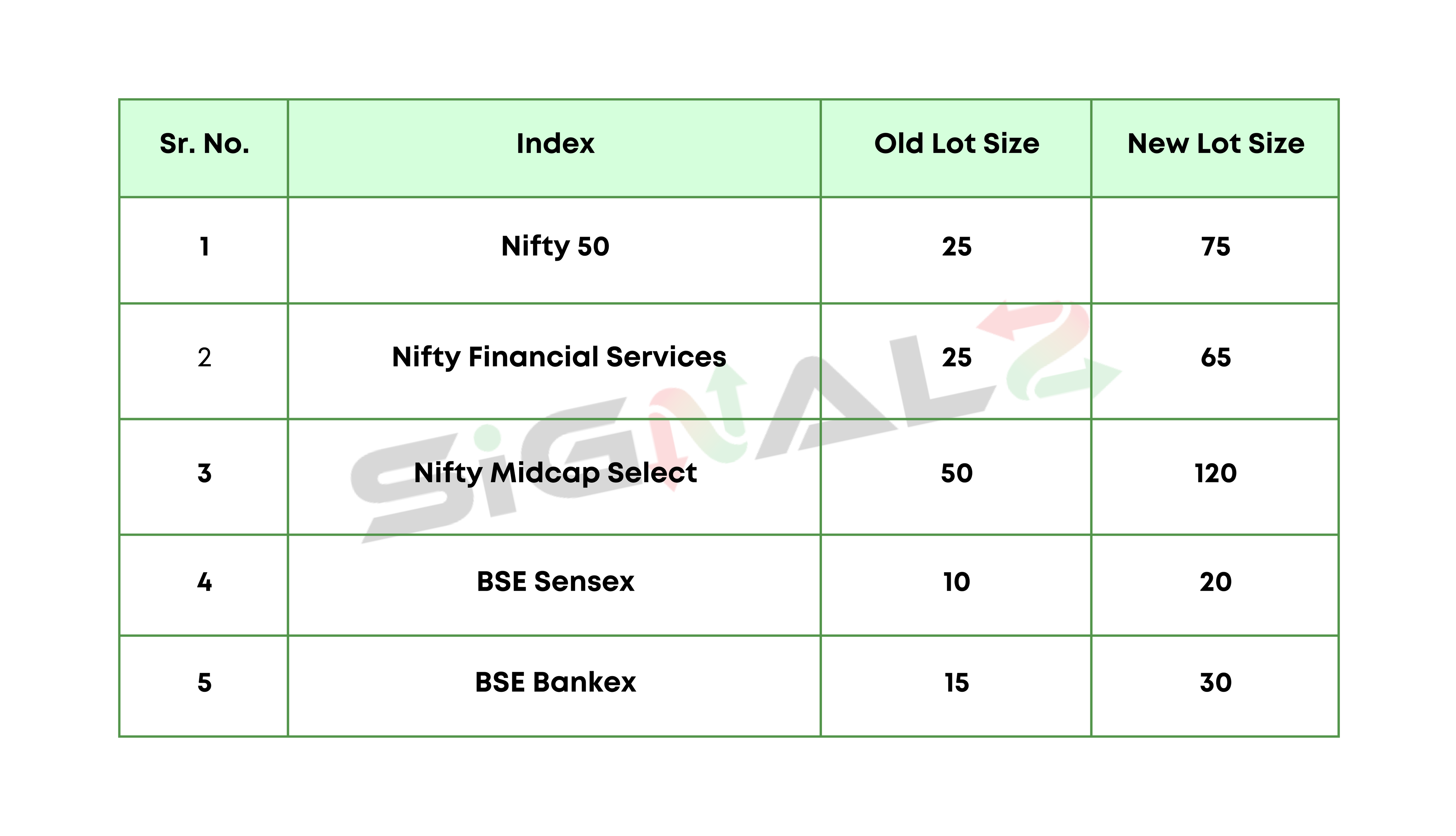

1. Increase in Contract Size (Effective November 20, 2024)

- This adjustment affects trading volumes and the margin requirements for each contract, so traders should plan their positions accordingly.

2. Weekly Expiry Contracts Limited (Effective November 20, 2024)

- Going forward, only Nifty 50 and Sensex will offer weekly expiry contracts.

- All other index options will have only monthly expiries, reducing the frequency of expiry-related market adjustments for other indices.

3. Additional Margins on Expiry Day (Effective November 20, 2024)

- To manage volatility, an Extreme Loss Margin (ELM) of 2% will be applied to short positions on expiry day.

- This is an added precaution to protect against sudden price movements, especially for traders with high exposure on expiry days.

4. No Calendar Spread Benefits on Expiry Day (Effective February 1, 2025)

- Margin benefits for calendar spreads will not be available on expiry day, impacting the cost efficiency for spread strategies during these times.

- This change is intended to further control market risk on high-volume expiry days.

5. Intraday Monitoring of Position Limits (Effective April 1, 2025)

- Position limits will now be monitored throughout the trading day rather than only at the end of the day.

- This adjustment enhances real-time surveillance to prevent potential breaches in position limits and helps in maintaining fair trading practices.

For further details, traders are encouraged to review the official circulars from NSE, BSE, and SEBI:

- NSE Circular: NSE/FAOP/64625 dated October 18, 2024

- BSE Notice: 20241021-13 dated October 21, 2024

- SEBI Circular: SEBI/HO/MRD/TPD-1/P/CIR/2024/13 dated October 01, 2024

These updates represent the ongoing efforts of SEBI and exchanges to refine market structure, enhance stability, and manage risks more effectively. Traders should review their strategies and adjust their risk management practices in light of these changes.

For any questions or support, feel free to reach out to our team at Signalz. Stay informed, stay prepared!